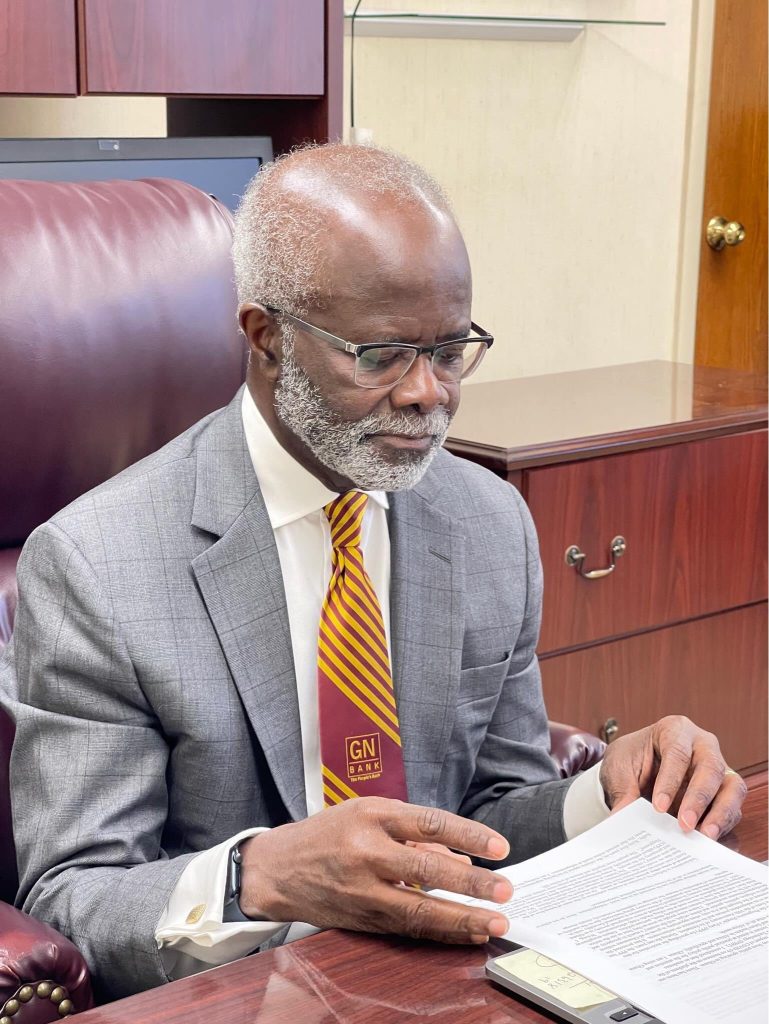

CEO of the defunct GN Bank, Dr Kwesi Nduom, has passionately appealed to the Governor of the Bank of Ghana, Dr Ernest Addison to reconsider new evidence and reinstate the bank’s revoked license.

In a Facebook post on June 23, Dr. Nduom strongly contested the BoG’s claims of GN Bank’s capital inadequacy.

He implored Dr Addison to reexamine the 2019 GN Savings and Loans transition report, which he claims demonstrates the bank’s sufficient funds.

Nduom emphasised,

“When people ask what we want, we say we recognise the proof of more money than was stated. We have continuously provided new facts to the BoG.

All we ask is for Governor Addison to acknowledge these new facts, restore our license, return our assets, ensure they are in good condition, and let’s move forward.”

Mr Nduom urged the central bank to maintain GN Bank’s assets in good condition, asserting their readiness to resume operations.

BACKGROUND

In 2018, the BoG revoked licenses from several financial institutions, including GN Bank, as part of efforts to consolidate the banking sector.

On June 14, the BoG justified its decision, citing significant regulatory breaches and GN Bank’s failure to meet essential financial regulations and banking standards, which jeopardised its operational stability.

Watch Video: